When you walk into a pharmacy and get a cheaper version of your brand-name pill, you might think it’s just a cost-cutting trick. But what do doctors and pharmacists in other countries really think about generics? It’s not the same everywhere. In some places, generics are the default. In others, they’re still met with hesitation. And in a few, they’re saving lives.

Europe: Generics as Policy, Not Just Preference

In Germany, France, and the UK, doctors don’t just accept generics-they’re encouraged to prescribe them. It’s not about trust. It’s about rules. Governments here have built systems where pharmacists can automatically swap a brand-name drug for a generic unless the doctor specifically says no. That’s called generic substitution.

Why? Because healthcare budgets are tight. In 2025, Europe spent over $122 billion on generic drugs. Germany alone accounts for nearly 16% of that. Doctors know the science is solid-same active ingredient, same effectiveness. But they also know that if they don’t prescribe generics, the system pushes back. Insurance reimbursements are lower for brand-name drugs. Hospitals get penalized for overspending.

Still, growth is slowing. The European generics market is growing at just 2-5% per year. Why? Because most of the low-hanging fruit is already picked. High-volume, low-cost pills like statins and blood pressure meds? Most are generic now. The next wave-complex injectables and inhalers-is harder to make and harder to replace. But doctors are starting to embrace those too, especially as hospitals push for cost control.

Asia-Pacific: Generics as Lifelines

Walk into a clinic in India or rural China, and you’ll rarely see a brand-name drug. Why? Because most people can’t afford them. Here, generics aren’t a cost-saving option-they’re the only option.

India makes about 20% of the world’s generic drugs. It supplies nearly 40% of all generic medications used in the U.S. That’s not a coincidence. Indian manufacturers cut costs by using local labor, simpler regulations, and decades of experience making bulk medicines. Doctors in India don’t debate whether generics work. They know they do. Their job is to get patients the medicine they need, not the one with the fanciest label.

China’s story is similar. With an aging population and rising diabetes and heart disease rates, the government pushed hard to expand generic access. In 2025, the Asia-Pacific region led the world in generic drug growth, with projections showing a 5-6.5% annual increase through 2034. That’s not just because people need cheaper pills-it’s because governments are making it happen. Price controls. Bulk procurement. National formularies that list only generics for common conditions.

Doctors here don’t see generics as a compromise. They see them as the foundation of public health.

United States: The High-Price Paradox

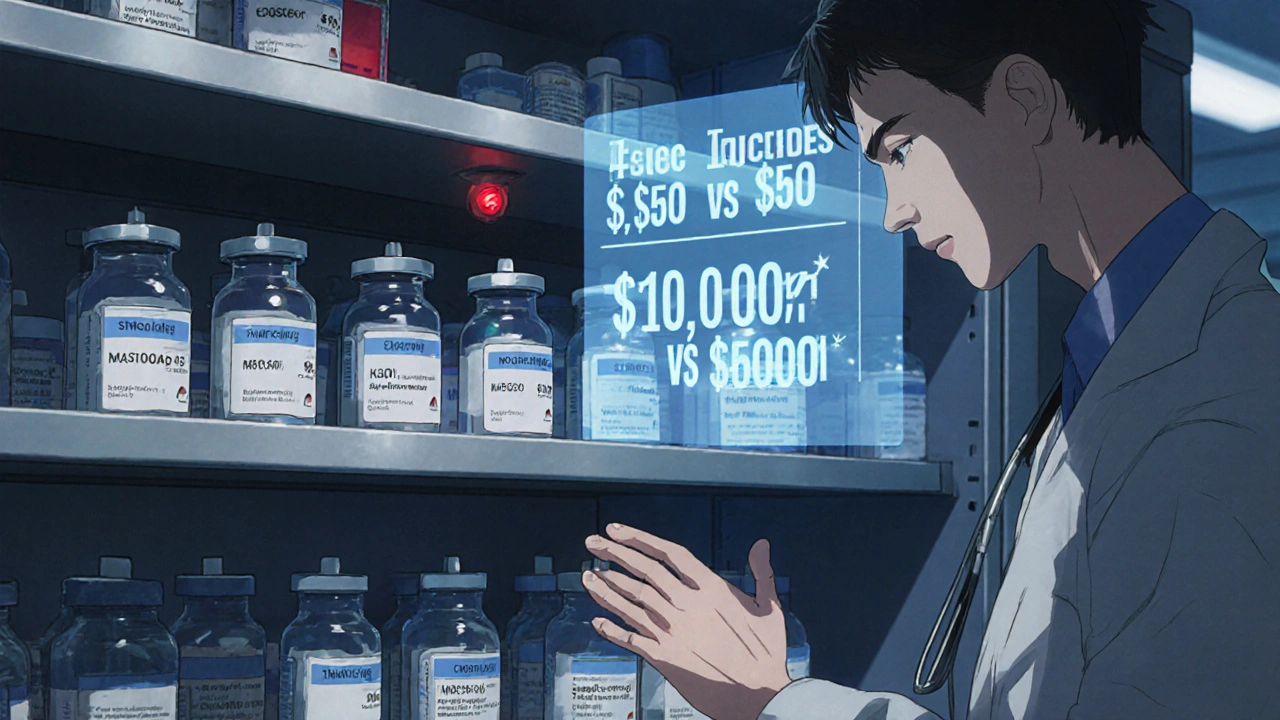

In the U.S., 90% of prescriptions are filled with generics. That sounds like a win. But here’s the catch: generics make up only 15-20% of total drug spending. Why? Because the brand-name drugs are still astronomically expensive. A single dose of a new cancer drug can cost $10,000. The generic version? $50.

Doctors know this. They push generics whenever they can. But they also face pressure from patients who’ve been told by ads or influencers that “the real medicine” is the brand name. Some patients refuse generics because they think they’re “weaker.” Doctors spend time explaining that the FDA requires generics to be bioequivalent-same absorption, same effect.

Then there’s the supply chain problem. In 2023 and 2024, the U.S. saw shortages of basic generics like antibiotics and IV fluids. Many of these came from India and China. When factories shut down for inspections or raw materials got delayed, doctors scrambled. That eroded trust. Now, even if a generic is cheaper, some providers hesitate if they’ve had bad experiences with inconsistent quality.

Still, the trend is clear: as more blockbuster drugs lose patents-like ustekinumab and vedolizumab, which together could generate $25 billion in generic sales by 2029-doctors are preparing for a flood of new options. The question isn’t whether generics will grow. It’s whether the system can handle the volume.

Japan: The Slow Turn to Generics

Japan used to be a brand-name stronghold. Patients trusted name brands. Doctors were slow to switch. But things changed.

Starting in 2015, the government introduced mandatory biennial price cuts for all drugs-brand and generic. Then they started pushing hospitals to prescribe generics first. By 2025, generic use had jumped to over 80% in outpatient settings. Doctors who resisted? They got fewer reimbursements.

Now, Japan’s pharmaceutical market is flat or even shrinking. Not because people are getting healthier-but because they’re using cheaper drugs. Generics are no longer a backup. They’re the standard. And doctors? They’ve adapted. They don’t need convincing anymore. The system did it for them.

Emerging Markets: Generics as Healthcare Infrastructure

In Brazil, Turkey, and parts of Africa, generics aren’t just affordable-they’re the only way to scale care. These countries don’t have the budgets for expensive biologics. So they invest in generics.

IQVIA estimates that “pharmerging” markets-places like India, China, Brazil, and Russia-will add $140 billion in drug spending by 2025. Most of that will go to generics. Why? Because governments are building systems around them. They buy in bulk. They train pharmacists to substitute. They subsidize distribution.

Doctors in these regions don’t have the luxury of choice. If a patient can’t afford a drug, they don’t get it. So generics become part of the treatment plan from day one. It’s not about preference. It’s about survival.

The Rise of Specialty Generics

Generics aren’t just pills anymore. The fastest-growing segment is specialty generics-injectables, inhalers, creams, and complex delivery systems. In 2025, this market was worth $76.5 billion. By 2033, it could hit $186 billion.

Why? Because chronic diseases demand long-term treatment. Diabetics need insulin pens. Asthma patients need inhalers. Cancer patients need IV chemo. Brand-name versions of these are expensive. But now, generics are catching up.

Hospitals are leading the charge. In the U.S. and Europe, hospital pharmacies are switching to generic injectables to cut costs. Doctors who once avoided them because of stability concerns are now prescribing them confidently. The science has improved. Manufacturing standards are tighter. And the cost savings? Sometimes 90%.

What’s Next?

By 2030, over $200 billion in brand-name drug sales will expire. That’s the biggest wave of patent expirations in history. Generics will flood the market. But will systems be ready?

In wealthier countries, the challenge will be managing quality and supply. In poorer ones, it’ll be access and distribution. But one thing is clear: doctors everywhere are moving toward generics-not because they have to, but because they realize they can’t afford not to.

Generics aren’t second-rate. They’re the backbone of affordable medicine. And the world is finally starting to see it that way.

Are generic drugs as effective as brand-name drugs?

Yes. Regulatory agencies like the FDA, EMA, and WHO require generics to have the same active ingredient, strength, dosage form, and bioavailability as the brand-name version. That means they work the same way in the body. Differences in fillers or coatings don’t affect effectiveness-only cost.

Why do some doctors still prefer brand-name drugs?

Some doctors stick with brands out of habit, patient pressure, or past bad experiences with inconsistent generic quality. In places with weak regulatory oversight, poor manufacturing has caused real problems. But in countries with strong systems-like the U.S., EU, or Japan-those concerns are rare. Most doctors now trust generics when they’re approved by credible agencies.

Why are generic drugs cheaper?

Generics don’t need to pay for drug research, clinical trials, or marketing. Those costs were already covered by the original brand. Generic manufacturers only need to prove their version is equivalent. That cuts production costs by 80-90%. Manufacturing in countries like India and China-where labor and materials are cheaper-adds to the savings.

Do generic drugs cause more side effects?

No. Side effects come from the active ingredient, not the brand. If a brand-name drug causes drowsiness or nausea, the generic will too-because it’s the same drug. Some patients report feeling different, but that’s often due to placebo effect or variations in inactive ingredients, not the medicine itself.

Why do some countries have more generic use than others?

It’s about policy, not culture. Countries with automatic substitution rules, price controls, and bulk purchasing-like Germany, India, and Japan-have high generic use. Countries without those systems, even if they’re wealthy, have lower adoption. It’s not that doctors or patients resist generics-it’s that the system doesn’t push them.

Can I trust generics made in India or China?

Yes-if they’re approved by a reputable regulator. India and China supply most of the world’s generics. Many of these factories are inspected by the FDA, EMA, or WHO. If a generic is sold in the U.S., EU, or Australia, it’s been vetted. The problem isn’t the country-it’s the unregulated black market. Always get generics from licensed pharmacies.

Are there any drugs that can’t be made as generics?

Yes. Biologics-complex drugs made from living cells, like insulin or cancer immunotherapies-are harder to copy. Their generics are called biosimilars, and they take longer to develop and approve. But many are now entering the market. By 2029, over $25 billion in biologic sales will be open to biosimilars, changing how doctors treat chronic diseases.

How do insurance plans influence generic use?

A lot. Many insurance plans charge higher copays for brand-name drugs. Some won’t cover them at all unless the doctor proves a generic won’t work. In the U.S., Medicare Part D plans push generics hard. In Europe, public insurers often mandate substitution. Insurance doesn’t just influence choice-it often controls it.

Write a comment

Your email address will be restricted to us